north carolina real estate tax records

Durham County Tax Administration provides online Real Property Records Search. A North Carolina Property Records Search locates real estate documents related to property in NC.

This site provides read access to tax record information from Onslow County North Carolina.

. Buncombe County Tax Dept. Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms. All information on this site is prepared for the inventory of real property found within Cabarrus County.

Wayne County Tax Collector PO. To access this information start by performing a search of the property records data by selecting. Visit North Carolinas MyDMV website for more information.

The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and. Public Property Records provide information on land homes and commercial properties. The Registry of Deeds is responsible for maintaining all property records for that county.

All data is compiled from recorded deeds plats and other public records and data. The mission of the Harnett County Tax Department is to provide fair and equitable appraisal assessment billing and collection of taxes on real business and personal property. 201 North Chestnut Street Winston-Salem NC 27101 Assessor PO.

Welcome to the NHC Tax Departments Property Assessment Website. We have placed a new secure outdoor. You can use this.

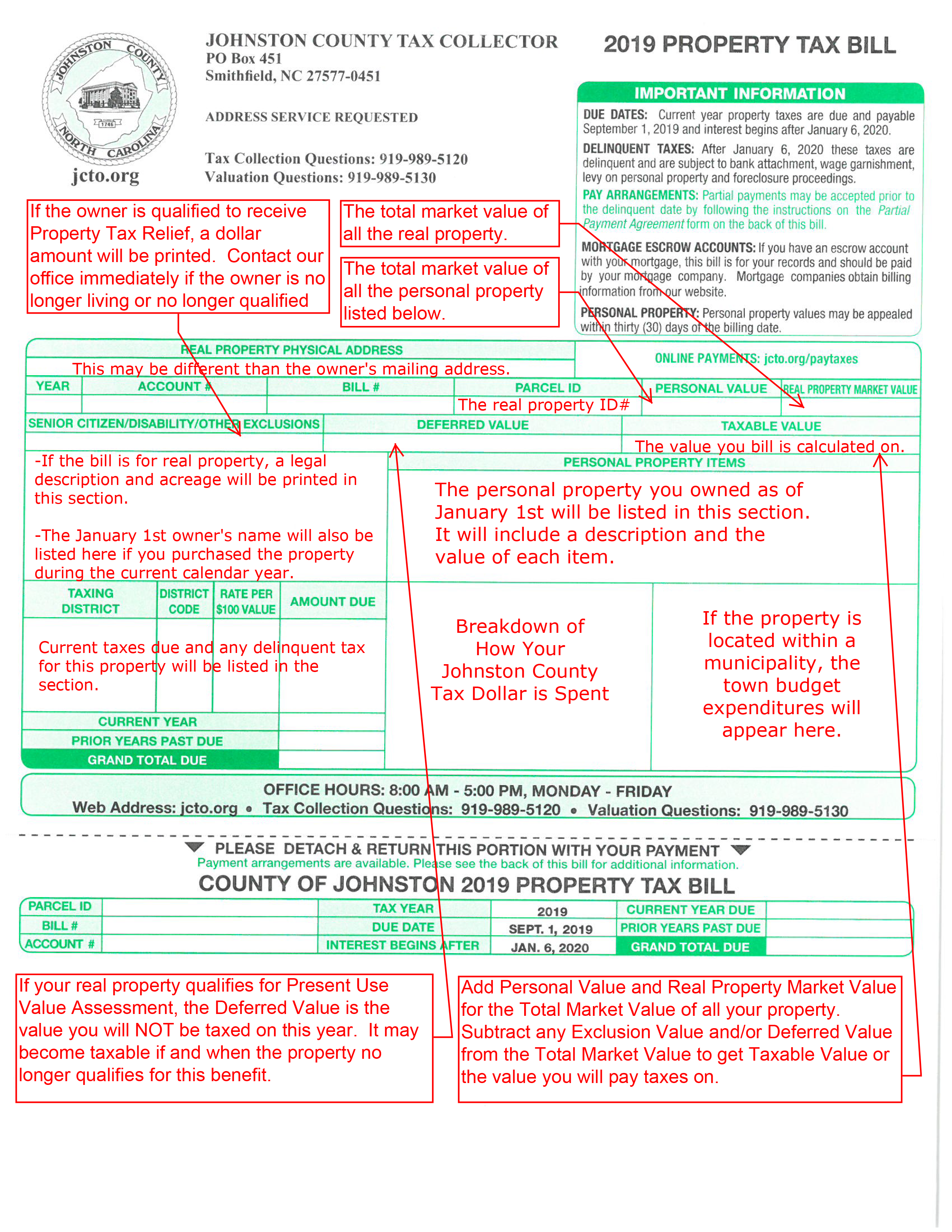

Payments Please send payments to. Real estate and personal property listed for taxation during January are billed in July and may be paid on or before. Property tax bills are mailed out in August and they must be.

The Horry County Assessors Office appraises and lists all real property for taxation and maintains ownership information. Search Catawba County property tax assessment records by address owner name subdivision parcel id or book and page number including GIS maps. Each county in North Carolina has its own Registry of Deeds office.

North Carolina Property Tax Records. 94 Coxe Avenue Asheville NC 28801 828 250-4910 or 250-4920. It reviews legal residence or primary residence applications.

Tax Assessor and Delinquent Taxes. Wake County Register of. Tax Department of Guilford County North Carolina.

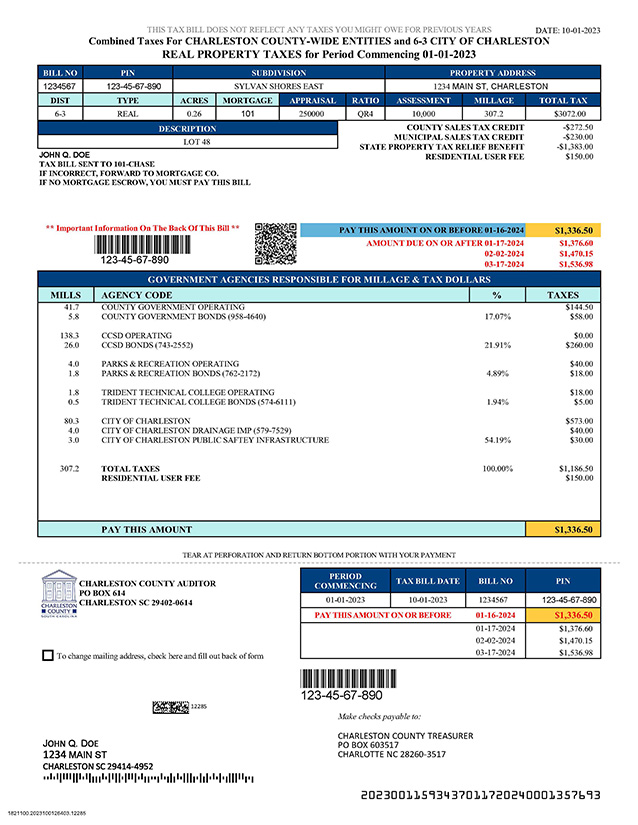

The convenience fee for Electronic Check transactions is 275 for each payment less than or equal to 10000 and 15 for each payment greater than 10000. According to the North Carolina Department of Revenue as of 2018 the average effective property tax rate in North Carolina is 085. Real estate taxes In fiscal year 2022-2023 the tax rate for residential property is set at 011 per 100 valuation.

The Real Property Records Search allows the user to obtain ownership information as of January 1. Box 1495 Goldsboro NC 27533. Box 757 Winston-Salem NC 27102.

This site provides assessed values and data extracted from the assessment records for residential.

Sample Real Property Tax Bill Charleston County Government

Notification And Appeal Process Union County Nc

Guilford County Tax Department Guilford County Nc

Free North Carolina Real Estate Purchase Agreement Template Pdf Word

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

North Carolina Property Tax Calculator Smartasset

How Taxes On Property Owned In Another State Work For 2022

Tax Lists Orange County 1779 Tax Lists And Records North Carolina Digital Collections

North Carolina Deed Forms Eforms

Dare County Tax Department Dare County Nc

North Carolina Secretary Of State Land Records Land Records

Real Estate Wake County Government

Tax Department Town Of Beech Mountain